Health Insurance for Over 50s in the UK

Home > Health Insurance > Health Insurance for Over 50s

Health Insurance for Over 50

Health Insurance for Seniors Over 50 is all about ensuring your well-being and peace of mind. In this article, we’ll explain why it’s a good choice and how it can keep you healthy and stressed. Healthcare matters a lot, especially if you’re over 50. At this age, it’s nice to see specialist doctors quickly, not wait long for NHS appointments, and have peace of mind about your health.

Navigate The Guide:

Get Tailored Health Insurance Quotes from Top UK Insurers

How it works

Step 1. Answer a few simple questions

Step 2. Get tailored quote

Step 3. Get covered and start saving

Why Choose Us

We offer completely free and no obligation advice on Private Health Insurance. Our experienced advisors will take the stress away from you and do all the hard work to find you the best provider by comparing quotes with the leading providers in the market. We have been working directly with AXA, Aviva, Bupa, and Vitality for over 40 years and tailoring the best policies for our customers.

Health Insurance People

Get expert advice from our dedicated health insurance advisors for free

24/7 Customer Care

You can contact us anytime and one of our health insurance consultants will always be available to you.

Claims Support

We will be there for you throughout the claims process to ensure that it is easy and stress-free.

How does healthcare for Over 50 work?

Personal health insurance coverage becomes essential for those over 50 as health risks rise with age. This insurance allows you to personalise plans, covering hospital stays and surgeries. You pay a monthly premium to cover inpatient and day-patient treatments, comprehensive cancer treatments, hospitalizations, and surgeries. If desired, you can opt for outpatient coverage, which includes specialist consultations and diagnostic tests. Additionally, since the COVID-19 pandemic, most insurers offer Digital GP services as a standard feature, ensuring quicker access to online doctors.

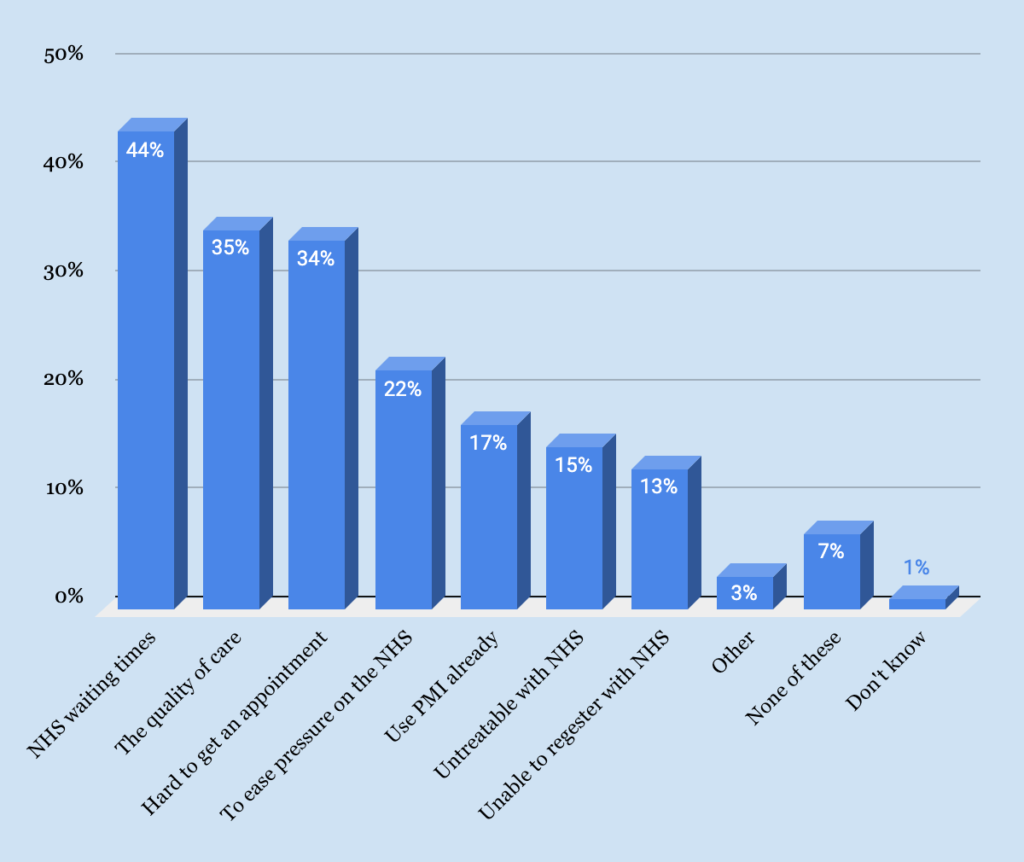

Ipsos surveyed to understand why individuals over 50 opt for health insurance. The chart indicates that dissatisfaction with long NHS waiting lists is a prominent reason. Hence, they choose cover to guarantee faster access to medical treatment, address age-related health concerns, and gain peace of mind while spending quality time with loved ones.

Why do over 50’s choose private health insurance?

Source Ipsos. Base: 776Online British adults who are using or considering using private healthcare services, August 2022

Why consider health insurance after turning 50?

Getting insurance after you turn 50 is vital because as you get older, the chances of facing health problems increase. Private health insurance means you have financial stability, better access to healthcare, and peace of mind as health issues become more common.

What Are the Benefits of Over 50s Health Insurance?

Health insurance for those over 50 provides essential benefits, including quicker access to treatments, a choice of specialists, and greater privacy. These benefits make over fifty health insurance a smart choice for maintaining your health and peace of mind. Here are the main reasons why someone aged 50 or older age might consider getting private health:

Health Insurance Benefits

Avoid lengthy NHS waiting lists and receive faster treatment.

Benefit from health insurance for over 50-year-olds by avoiding NHS waiting lists and receiving quicker private treatment. Regardless of your age, this insurance helps you skip delays. Opt for a comprehensive plan with outpatient coverage, and you can also enjoy the benefit of private tests, diagnostics, scans and consultations.

Freedom in choosing treatment time and location.

With private medical insurance, you have the freedom to choose when and where you receive treatment. This flexibility allows you to schedule treatment around your commitments and select a convenient location. You also have the option to choose your preferred healthcare specialist.

Comprehensive cancer cover

The private cover provides cancer coverage, addressing increasing cancer worries. It offers benefits like early detection, specialist consultations, diagnostic tests, non-NHS treatments, hospitalisation, and prescription medications. Additionally, it includes home healthcare, mental health support, and extras such as wigs and hospice care.

24/7 virtual GP service

With all insurance providers, you gain 24/7 access to digital GPs. This means you can consult certified private doctors via phone or video calls at any time, providing convenience and reducing the reliance on urgent care visits and NHS 111 services.

Private Room

You have the option to choose a private room, allowing you to avoid sharing with others. In this private space, you’ll have an en-suite bathroom, TV, special care, and a restaurant-style menu. Plus, your loved ones can visit you at any time, not limited to designated visiting hours.

Extra benefits

Private health insurance for those over 50s offers extra benefits such as dental, optical, mental health, therapies, and optional travel coverage for an additional fee. These enhancements provide comprehensive healthcare, especially for those aged 50 and above, ensuring well-rounded health coverage.

Our expert says…

“Private Medical Insurance is becoming increasingly more popular due to the longer waiting times through the NHS and most people assume PMI will not be affordable given the increased cost of living over the past 12 months. However, as an independent broker with access to the leading UK insurers such as Aviva, AXA and Bupa to name a few, there are hundreds of variations available at any one given time and therefore policies can be tailor-made to meet their requirements and budget.“

What does health insurance over-50s cover?

Within this section, we offer an overview of the typical coverage provided by private medical care. It’s important to note that the scope of coverage can vary significantly based on the specific policy you choose, the offerings provided by your insurer, and your individual medical history.

Cover may include –

Treatment for New Acute Conditions

Typically covers treatment for acute conditions that arise after your policy starts.

Inpatient and Day Patient Care

Includes coverage for private hospital stays, granting you a private room with facilities, often including an ensuite bathroom.

Comprehensive Cancer Cover

Get Mental Health added to your policy to cover mental health conditions and provide support and cover the cost of recovery.

24/7 Virtual GP and Wellness Helplines

Many policies offer round-the-clock easy access to virtual General Practitioners and wellness support lines

Outpatient Services

This encompasses outpatient treatments, diagnostic scans, tests, and consultations. You can opt for additional outpatient cover

Specialist Consultations

Some policies extend coverage to consultations with specialists like osteopaths, chiropractors, acupuncturists, and podiatrists. You may also have the option to include therapy cover

Dental & Optical Cover

You can often add routine dental and optical care to your policy for an extra cost.

Mental Health Cover

Covers therapy and treatment to promote emotional well-being and ensure access to essential mental health support

Worldwide Travel

Insurers like AXA and Vitality offer this option to ensure protection and assistance for unexpected events abroad

What to consider when choosing health insurance in Over 50s?

When selecting Health Insurance for those Over 50s in the UK, it’s vital to assess several factors. Evaluate the policy’s cover options, including tailored benefits for older individuals, accessibility to preferred healthcare providers, premium affordability, and policy flexibility to align with specific needs and preferences.

Private Hospitals

Private hospitals have different service levels to suit various preferences and budgets. The least expensive option lets a consultant choose your hospital. In the mid-range, you have access to many hospitals across the UK. The top tier includes prestigious London HCA hospitals, which offer premium services at higher prices. It’s also worth mentioning that some NHS hospitals have private sections. To learn more about private hospitals, you can read our detailed article here.

Extent of Coverage

Understanding the extent of coverage is crucial for making an informed choice when selecting the right health insurance for those over 50s in the UK. It outlines the range of risks or situations that are included or excluded from your insurance. Knowing this helps you understand how well you’re protected and any restrictions that may apply.

Underwriting Options

When choosing medical insurance for individuals over 50, it’s essential to grasp the various underwriting options:

- Moratorium: This option typically excludes pre-existing medical conditions for a set period, offering affordability with some limitations.

- Full medical underwriting: It involves a comprehensive assessment of your medical history, providing clarity and tailored coverage.

- Continued personal medical exclusions: When transitioning between insurers or your company scheme, you may retain your existing coverage, ensuring continuity.

- Medical history disregarded: This option, though more expensive, disregards your medical history, offering the most comprehensive coverage.

Choose the underwriting option that best suits your needs and budget when choosing affordable health insurance.

Supplementary Choices

When assessing insurance choices, you have the option to enhance your coverage with additional add-ons. These can encompass mental health, optical and dental coverage, therapeutic services, travel insurance, as well as outpatient coverage for specialists, tests, scans, and diagnostics. These extras can provide a more tailored policy but may increase your premium cost.

How much does health insurance cost for a 50-year-old?

Our insurance advisors obtained a quote for individuals aged 50-70 with no pre-existing conditions, a healthy lifestyle, and a mid-range hospital list. The policy includes a £250 excess, standard outpatient and falls under the Moratorium underwriting option. This information can help you assess the estimated premium cost for this specific scenario:

| Insurer | 50 years old | 60 years old | 70 years old |

|---|---|---|---|

| AXA | £102.93 | £130.10 | £160.56 |

| AVIVA | £98.17 | £106.98 | £132.20 |

| BUPA | £115.35 | £137.08 | £158.91 |

| WPA | £137.21 | £151.13 | £178.31 |

| THE EXETER | £106.43 | £123.56 | £180.15 |

| VITALITY | £88.62 | £100.01 | £138.45 |

| FREEDOM | £129.84 | £154.21 | £188.67 |

Basic Plan

A basic plan offers full coverage for inpatient and day patient care, including a basic hospital list. However, it does not include outpatient coverage, which means expenses for specialist consultations, tests, and diagnostics outside of a hospital stay are not covered by this plan

A Mid-Range Plan

A mid-range plan provides cover for full inpatient and standard outpatient. It typically offers access to a broader network of hospitals and specialists compared to basic plans. This option strikes a balance between coverage and affordability, making it a popular choice for many individuals and families.

Comprehensive Coverage

This cover is an extensive plan that includes a wide range of benefits. This typically includes full inpatient and outpatient care, and full cancer cover. Comprehensive plans offer robust protection and peace of mind for policyholders. This level of cover typically comes at a higher premium.

How to save money on health insurance?

There are several ways to reduce your health insurance premium without compromising coverage, consider these strategies. Increasing your excess, opt for a “guided consultant” list; this will reduce the premium by 20%. Alternatively, reduce coverage by removing extra options, setting outpatient limits, or eliminating outpatient coverage.

Additionally, you have the option to choose a 6-week NHS waiting period or downgrade your cancer treatments to NHS treatment. To navigate the process of reducing your insurance costs effectively, it’s advisable to reach out to our health insurance expert. They will provide expert advice to help you find the best policy that aligns with your specific needs.

What is not covered by health insurance?

While private medical insurance cover offers valuable benefits, it doesn’t replace the entirety of healthcare needs, and certain services may still require NHS reliance.These conditions and services are excluded:

What is the best healthcare insurance provider for over 50s?

WPA

WPA offers comprehensive insurance with Premier and Elite options, including cancer benefits, top consultants, and UK hospitals. Claims don’t affect renewal costs under a community-rated scheme. Their policies cover therapies, dental, and outpatient care, with up to 20% discounts for self-employed and professional workers. High customer satisfaction and non-profit status make WPA a leading UK choice.

BUPA

Bupa’s primary private medical policy, the Bupa By You Comprehensive plan, offers distinct advantages. Notably, Bupa provides direct cancer support without requiring a GP referral, thanks to their Bupa Direct Access service. Age isn’t a barrier, as there are no age restrictions for new customers, making Bupa services accessible even for those over 65 or 70. The plan also includes standard coverage for therapies and mental health, up to specified limits for outpatient treatments. These features position Bupa as an excellent choice for comprehensive policy.

- Chemo/radiotherapy

- Genetic testing to match chemotherapy

- Hormone therapy

- Bone-strengthening drugs

- Bone marrow/stem cell transplants

- Bypass GP and go directly

- NHS Cash Benefit- £100 per night up to 35 nights per year if you opt out for NHS treatments

- Cashback for wigs and prostheses

Note. Bupa does not pay charitable donations towards end-of-life / palliative care in a hospice.

The Exeter

The Exeter Health+ stands out as an exceptional choice for private medical insurance, excelling in both coverage and customer service. What sets them apart is their commitment to providing options. You can opt for a standard “protectable” discount or a unique “community-rated” system that safeguards your policy renewal even after a claim, a feature exclusive to individuals aged 70 to 80. The Exeter Health+ is ideal for those seeking flexible and dependable cover, prioritising innovation and customer satisfaction. It’s a compelling option for anyone seeking quality health insurance covers.

- Chemo/radiotherapy/options for home treatment

- Hormone therapy

- Bone-strengthening drugs

- Bone marrow/stem cell transplants

- NHS Cash Benefit-£150 per night up to 30 nights per year if you opt out of NHS treatment

- Monitoring and follow-up

- Hospice donation of £250

Note. The Exeter does not cover preventative treatment

AXA

AXA is highly regarded in the insurance market, earning excellent reviews for its comprehensive coverage. Their health plans encompass inpatient and outpatient treatments at over 250 hospitals across the UK. While outpatient coverage may involve an extra cost, AXA’s flexibility and extensive network make it a top pick for family health insurance. Their unwavering dedication to customer satisfaction has solidified their reputation as a top-tier insurer, valued by policyholders for its exceptional service and comprehensive coverage options.

- Chemo/radiotherapy/options for home treatment

- Genetic testing to match chemotherapy

- Hormone therapy

- Bone-strengthening drugs

- Bone marrow/stem cell transplants

- Hospice donation of £100

- NHS Cash Benefit

- Up to £500 for wigs and £5000 for prostheses

Note. Axa will pay for any drags not routinely available with NHS if the policy is downgraded

AVIVA

Aviva Health offers a wide range of coverage options, making it a versatile choice for individuals and families. Their plans encompass inpatient and outpatient treatment, and they have a sizable network of hospitals and specialists. Aviva also provides options for dental, optical, and mental health coverage. They focus on delivering quality care and customer satisfaction, making them a reputable player in the market. With their flexible plans and commitment to meeting diverse healthcare needs, Aviva is a strong contender for those seeking comprehensive health insurance cover.

- Chemo/radiotherapy/options for home treatment

- Bone-strengthening drugs

- Bone marrow/stem cell transplants

- Preventative treatments

- NHS Cash Benefit-£100 per night up to 28 nights per year if you opt out for NHS treatments

- Up to £500 for wigs and £5000 for prostheses

- Hospice donation

- Monitoring and follow-up

Note. Aviva does not pay for harmony therapy unless it’s medically necessary.

For additional health cover reviews and information, explore our comprehensive “Best Health Insurance in the UK” article available here.

Making Health Insurance Easy for Over 50s

In conclusion, choosing the best health insurance for over 50s in the UK offers significant benefits that cater specifically to the health needs and preferences of this age group. It is crucial due to increased medical needs as we age, such as preventive care, chronic disease management, and potential surgeries. It helps cover the high costs of healthcare, so we don’t have to use up our savings or retirement money. As we age, we’re more likely to have health problems, so insurance ensures we can get treatment when we need it. It also pays for regular doctor visits, which can catch problems early. Ultimately, health insurance offers peace of mind, allowing older adults to focus on enjoying life and family instead of worrying about healthcare expenses.

What customers say about us

Frequently Asked Questions

Other types of health insurance policies

Have any questions?

Send us a message and one of our dedicated advisors will contact you shortly.