Health Insurance for Seniors Over 70s in the UK

Home > Health Insurance > Health Insurance for seniors over 70

Health Insurance for Over 70s

Health insurance as a senior can be challenging, but options exist. Even if you’re over 70, you can access private healthcare. This guide will provide essential information on which providers accept seniors and how much it costs. Health Insurance for Seniors Over 70s is a specialised type of Private Medical Insurance designed to cover private medical costs for those aged 70 and above. It provides access to private treatment for acute medical conditions, helping seniors bypass long NHS waiting lists and receive timely, high-quality care.

Navigate The Guide:

Get Tailored Health Insurance Quotes from Top UK Insurers

How it works

Step 1. Answer a few simple questions

Step 2. Get tailored quote

Step 3. Get covered and start saving

Why Choose Us

We offer completely free and no obligation advice on on private health insurance for over 70s in the UK. Our experienced advisors will take the stress away from you and do all the hard work in finding you the best Provider by comparing quotes with the top leading providers in the market. We have worked directly with AXA, Aviva, Bupa, and Vitality for over 40 years, we have been tailor-making the best private health insurance for over 60s UK.

Professional Health Insurance Brokers

Get expert advice from our dedicated health insurance advisors for free.

24/7 Customer Care

You can contact us anytime, and one of our health insurance consultants will always be available to answer your questions.

Claims Support

We will be there for you throughout the claims process to ensure that it is easy and stress-free.

How does health insurance for seniors in the 70s work?

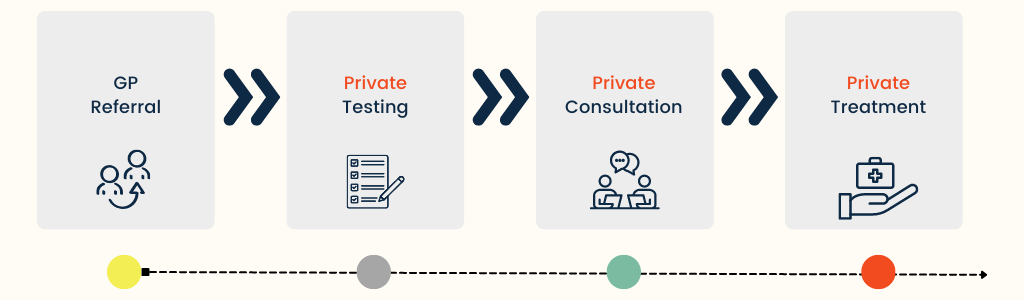

Health insurance for elderly in their 70s works similarly to standard private medical insurance. You pay monthly premiums to maintain your policy, which typically covers acute medical conditions. Policies often cover full inpatient treatments and may include outpatient cover, though specifics can vary by plan.

When you need treatment, you can make a claim for covered services, usually requiring a referral from your GP. After obtaining authorisation from your insurer, you can find a specialist or request one from your provider. You may need to pay an excess before receiving treatment and diagnoses privately.

However, keep in mind that common exclusions include pre-existing conditions and certain treatments not considered medically necessary.

Is It a Replacement for the NHS?

No, it is not a replacement for the NHS. Health insurance over 70s is designed to supplement NHS services, allowing you quicker access to private care for certain conditions. Depending on your cover level, you can still use NHS services for specific health issues.

Health Insurance with No Outpatient Cover

For example, if your policy does not include outpatient treatment, you may need to use NHS services for outpatient and diagnostic treatments.

Health Insurance with Outpatient Cover

If you have some level of outpatient or comprehensive plan, you can bypass NHS treatment, ensuring quicker access to necessary treatments.

You can use a virtual GP for referrals and prescriptions; however, some providers may request your medical history for a specific condition from your NHS GP.

Can Over 70 Get Health Insurance?

At 70, it’s important to consider your health care as part of your retirement planning. Nowadays, many insurance companies like National and Friendly, SAGA and WPA offer plans specifically for seniors, covering everything from chronic conditions to regular medical visits.

While there may be fewer options and higher premiums, these plans are designed to address the unique health needs of older adults. Make sure to compare the level of cover, costs and insurance providers to find a plan that guarantees the care you deserve.

What is covered under senior over 70s insurance?

It’s important for you to understand that over 70 health insurance policy, like other types of health insurance, mainly covers acute conditions.

Acute Condition

An illness that happens suddenly without any existing symptoms is known as acute illness. For example, your policy might cover hip replacement or fixing the broken bone, which usually gets better with the right treatment. However, for long-term or ongoing health problems, called chronic conditions, you may still need to use the NHS for some treatments and regular care.

Outpatient Treatment

Outpatient cover includes treatments that don’t require an overnight stay. You can choose your level of outpatient coverage:

- No Outpatient Cover – No outpatient treatments included.

- Limited Outpatient Cover – Covers basic diagnostic tests and a few consultations.

- Comprehensive Outpatient Cover – Includes a broad range of services like diagnostic tests and specialist consultations.

Inpatient Treatment

Inpatient treatment, which includes any care requiring a hospital stay, is covered in full as standard by most private health insurance plans. This cover includes:

- Hospital bed and accommodation

- Surgeries

- Essential medical care

Cancer Care

Comprehensive cancer care is included as standard in most senior health insurance plans, providing access to:

- Chemotherapy and radiotherapy

- Bone-strengthening drugs

- Surgical procedures

- Financial support for prosthetics or wigs

Note: To reduce your monthly premium, you can opt to downgrade your cancer cover to NHS treatments, although comprehensive cancer cover is typically recommended for full access to advanced treatments.

Our expert says…

“Private Medical Insurance is becoming increasingly more popular due to the longer waiting times through the NHS and most people assume PMI will not be affordable given the increased cost of living over the past 12 months. However, as an independent broker with access to the leading UK insurers such as Aviva, AXA and Bupa to name a few, there are hundreds of variations available at any one given time and therefore policies can be tailor-made to meet their requirements and budget.“

What is not covered in senior over 70s health plans?

Insurance policies have some common exclusions for everyone, no matter their age. These include:

- Pre-existing Conditions which you had before the policy started aren’t covered.

- Accident and Emergency, life-threatening situations are usually handled by NHS A&E services.

- Treatments for Alcohol Abuse or drug problems aren’t covered.

- Non-essential cosmetic procedures aren’t covered.

- Treatments for HIV/AIDS aren’t included.

- Ongoing kidney dialysis isn’t covered.

- Injuries from dangerous sports or hobbies aren’t covered.

- Chronic conditions

Chronic conditions

Chronic conditions, which are illnesses without a cure or those requiring long-term treatment, are typically excluded from all health insurance policies. These are:

- Diabetes

- Asthma

- Hypertension (High Blood Pressure)

- Arthritis

- Multiple Sclerosis (MS)

- Chronic Obstructive Pulmonary Disease (COPD)

- Heart Disease

- Rheumatoid Arthritis

How Much is Health Insurance for a 70 Year Old in the UK?

For a 70-year-old in the UK, health insurance can range from about £122 to £311 per month, depending on your choices and circumstances. Finding out how much health insurance costs when you’re 70 years old in the UK involves considering several key factors. Let’s break them down so you can get a clearer picture.

Health insurance Provider

Different insurance providers charge different premiums. This is because each company has its own way of assessing risk and the services they offer. Here’s an example to give you an idea:

| Provider | Monthly Premium (£) |

|---|---|

| AXA | 241.89 |

| AVIVA | 265.13 |

| Bupa | 224.51 |

| Vitality | 213.97 |

These prices are for comprehensive cover with a £100 excess.

Level of Outpatient Cover

The amount of outpatient cover you choose affects your premium. Here are some examples:

| Type of Plan | Outpatient Cover (£) | Monthly Premium (£) |

|---|---|---|

| Basic | 0 | 141.15 |

| Mid-Range | 1,000 | 163.09 |

| Comprehensive | Full | 239.11 |

The more outpatient cover you have, the higher the premium.

Excess

An excess is the amount you pay upfront before your insurance kicks in. A higher excess usually means a lower monthly premium. For example:

| Excess (£) | Monthly Premium (£) |

|---|---|

| 0 | 279 |

| 100 | 220 |

| 250 | 182 |

| 500 | 170 |

| 1,000 | 125 |

Choosing a higher excess can help reduce your monthly payments.

Age and Smoker Status

As you get older, health insurance costs more because the risk of health issues increases. For a 70-year-old, the costs look something like this:

| Age (Years) | Monthly Premium (£) |

|---|---|

| 70 | 251 |

| 75 | 289 |

| 75 | 311 |

Also, if you smoke, expect to pay more due to the higher health risks:

| Smoker Status | Monthly Premium (£) |

|---|---|

| Smoker | 272 |

| Non-Smoker | 251 |

Location

Where you receive treatment and where you live also impact the cost. Policies that cover top private hospitals, especially in places like Central London, are more expensive. Limiting your hospital network or choosing consult select hospital list can reduce monthly premium. For example health insurance provider Freedom Health, do not base premiums on location, which can be a cost-saving option if you live in an expensive area.

The 6-Week Wait Option

Aviva Health offers a “6-week wait” option to help reduce premiums. With this option, your insurance policy will only pay for inpatient treatment if the NHS waiting list is longer than six weeks. If the NHS can provide the treatment you need within six weeks, you’ll use NHS services instead of private care. This option does not affect outpatient care, which is still covered privately if included in your plan. This can be particularly beneficial for pensioners over 70, as it helps manage healthcare costs while still providing timely access to necessary treatments through the NHS.

For example, opting for the 6-week wait option could lower your premium by 30%.

What additional benefits are available?

You can enhance your basic health insurance plan by adding additional benefits for over 70s for an extra cost. While this will increase your monthly premium, it can significantly improve your coverage. Here are some options you might consider:

Mental Health Cover

Many insurers provide basic mental health support, such as access to a helpline or a short course of therapy. However, if you require more extensive care, including inpatient treatment for a psychiatric condition, you will need to add this benefit to your insurance plan for private treatment.

Dental and Optical Cover

Adding dental and optical benefits can cover expenses for routine check-ups, treatments, and corrective lenses, ensuring you have comprehensive coverage for your oral and visual health.

Physiotherapy and Alternative Therapies

If you’re interested in alternative therapies like homeopathy or acupuncture in addition to traditional treatments, you can opt to include these as added extras. You can also extend the number of treatment sessions available for physiotherapy, acupuncture, chiropractic care, or osteopathy. Notably, Bupa includes this as a standard benefit.

Worldwide Travel Insurance over 70’s

Senior citizens often face difficulties obtaining travel insurance, especially if they have high-risk medical conditions. Some health insurance plans allow you to add travel insurance, which can help you secure coverage and save money. This addition can be particularly beneficial if you plan to travel extensively during your retirement.

1 Month Free Cover

We offer 1-month free coverage if you take a health insurance policy with us.

Call us on 02045250884 or send us an email to conatct@premierpmi.co.uk

What should I consider when choosing medical insurance for over 70s?

When selecting health insurance for someone over 70, one of the first things to consider is access to quality healthcare facilities. Look for a plan that includes a network of nearby private hospitals. Having access to these hospitals can be crucial in emergencies or for routine visits, so ensure they are conveniently located.

Level of Cover

At this stage in life, comprehensive coverage becomes even more important. You should check if the policy covers all essential aspects of inpatient care, including hospital stays, diagnostic tests, surgeries, and follow-up treatments. Could you verify that the plan offers adequate coverage for a wide range of medical needs and conditions common among older adults?

Monthly Premium

While the cost of private health insurance for over 70s is a factor, it shouldn’t be the only consideration. Compare different policies to find a balance between cost and the extent of coverage. Be sure to look at both the premiums and any additional charges that may apply, such as deductibles or co-payments.

Underwriting Method

Examine how different plans handle underwriting for pre-existing conditions, which are more likely to affect seniors. Ensure that the policy covers conditions like heart disease or arthritis, and check for any waiting periods or exclusions.

Who Are The Best UK Health Insurance Companies For Seniors?

Selecting the right health insurance as a senior involves careful consideration of several factors, including the range of services offered, coverage limits, and any potential exclusions. Here’s a brief overview of some leading UK providers to help you make an informed decision:

Aviva offers comprehensive coverage with a range of hospital options and extensive cancer cover. Their policy includes 24/7 access to a digital GP and stress counselling. However, Aviva only covers the UK, Channel Islands, and the Isle of Man, so if international coverage is important for you, this might be a limitation.

AXA Health provides excellent coverage with no upper age limit. Their plans include day-patient and inpatient care, as well as unlimited physiotherapy and chiropractic treatments. With access to 250 private facilities in the UK, AXA Health is a solid choice for those seeking extensive outpatient care.

Bupa is well-known for its extensive network of private hospitals and comprehensive treatment options. Their policies include mental health support and cancer treatment without the need for a GP referral. Bupa also offers health check discounts and rewards for policyholders.

National Friendly does not have upper age limits and strives to keep premiums affordable. They offer a price promise, though age-related conditions might be excluded, so clarifying this with them is advisable.

WPA offers highly flexible policies with a broad choice of hospitals and consultants. Their outstanding customer service and customisable plans make them a top contender.

Saga caters specifically to those over 70, offering a range of plans from basic to comprehensive coverage. Their policies include inpatient and outpatient care, mental health support, and an NHS cash benefit.

Tips on reducing health insurance costs for seniors over 70s.

Reducing health insurance costs for seniors over 70 in the UK can be challenging, but there are some ways which you may consider:

Review Your Policy Regularly

Make sure your current policy is still the best option for your needs. Compare the coverage and costs with other available policies to ensure you’re getting the best deal.

Shop Around

Use independent broker to find the best health insurance for over 70 years old, explore different insurance providers and plans. Prices and cover can vary significantly, so it’s worth taking the time to compare.

Check for Discounts

Some insurers offer discounts for certain groups or for bundling multiple types of insurance. Look for any discounts you might be eligible for.

Increase Your Excess

Opting for a higher excess (the amount you pay out of pocket before insurance kicks in) can reduce your premium. Just make sure the excess is manageable for you if you need to make a claim.

Consider a Basic Plan

If you’re in good health and don’t require extensive coverage, a more basic plan might be sufficient. Focus on essential coverage and add-ons only if necessary.

Use NHS Services

The NHS provides comprehensive coverage for most healthcare needs in the UK. Make sure you’re fully aware of what’s available to you through the NHS, as this can sometimes reduce the need for extensive private health insurance.

Why Choose Us?

Navigating the world of Senior Private Health Insurance can be challenging, especially with the multitude of policy options and terms to consider. This can become even more complicated if you have pre-existing or chronic medical conditions.

At PremierPMI, we specialise in simplifying this process for you. We understand that finding the best health insurance for seniors over 70 uk involves more than just comparing premiums; it requires a thorough assessment of plan options, policy benefits and budget you are comfortable with.

What customers say about us

Frequently Asked Questions

Have any questions?

Send us a message and one of our dedicated advisors will contact you shortly.