How much is private health insurance in the UK?

Private health insurance costs in the UK vary depending on your age, where you live, and your lifestyle. While the NHS is free for everyone, private health insurance offers benefits packages such as quicker access to treatments, comfort, and personalised services. Private health insurance prices vary for each person. For those under 60 years old, it might be around £100 per month. If you’re over 60, it could be about £150 monthly. Remember, these are just estimates, and your actual costs may vary. Choose private health insurance for tailored care that fits your life.

Get Tailored Health Insurance Quotes from Top UK Insurers

What is the average price of private medical insurance in the UK?

The cost of private health insurance can be influenced by various factors. While some factors are beyond our control, such as age, there are others that we can manage, like our lifestyle choices.

Age is a significant factor affecting insurance premiums. As we age, the likelihood of requiring healthcare services and making claims increases, prompting insurers to adjust premiums accordingly.

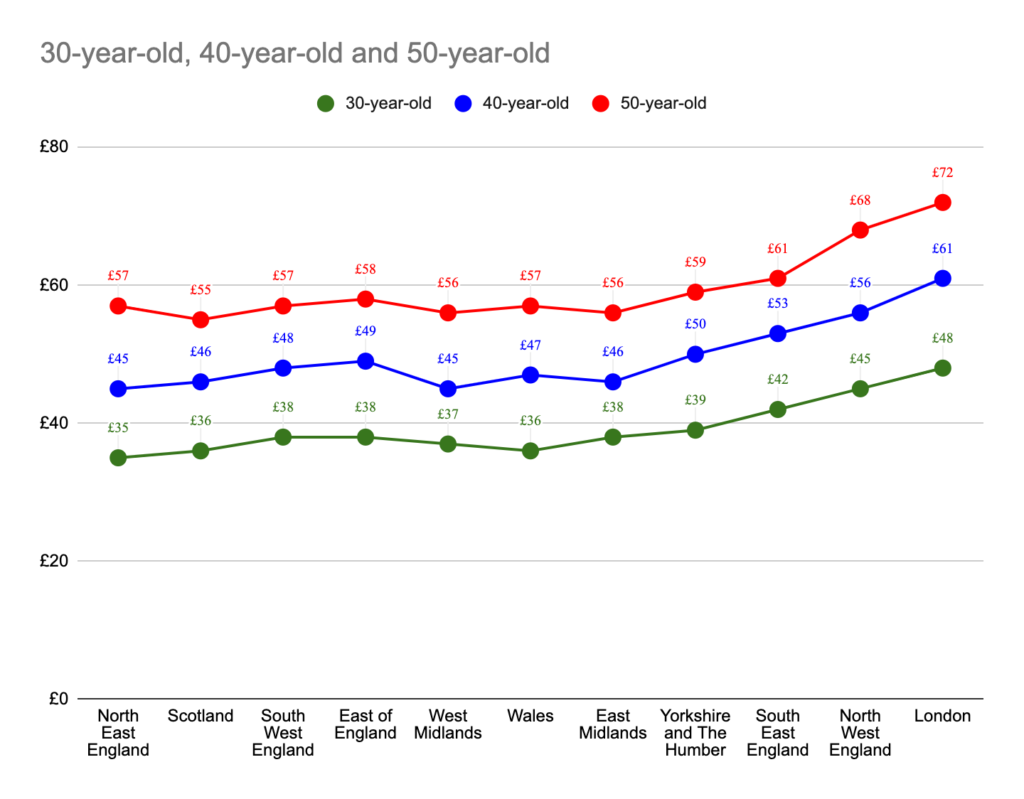

Additionally, your location within the UK can impact the price of health insurance. Below are the average monthly cost of health insurance for healthy, non-smoking individuals aged 30, 40, and 50, broken down by regions in the UK:

As seen in the table, private health insurance costs vary significantly in the UK. The North East has the lowest average premium at £35 per month, while London is the most expensive at £46 monthly. Age also plays a significant role, as highlighted earlier, affecting health insurance premiums considerably.

We all like getting a good deal, but it’s smart to think about spending a little more on private health insurance when you can. Just because a plan is cheap doesn’t mean it’s the best. Many affordable plans give you great coverage! What’s important is taking some time to look into and think about what you need from your health insurance. This way, you can pick a plan that’s just right for you.

How much does private healthcare cost per month?

The cost of private health insurance is influenced by several personal factors: your specific needs, location, age, and health condition. It also depends on factors like the hospital preferences and any additional coverage options you may want, such as dental or travel coverage. Our specialists have conducted research focusing on three age groups: 30, 40, and 50-year-old individuals who are healthy non-smokers living in London. We’ve compared prices for three types of coverage: basic, mid-range, and comprehensive, each with varying excess options. Here are the monthly premium rates for various age groups:

Health Insurance Cost Comparison

| Health Insurance for 30-year-old | ||||

| Cover | £0 EXCESS | £100 EXCESS | £250 EXCESS | £500 EXCESS |

| BASIC | £38 | £35 | £32 | £30 |

| MID- RANGE | £58 | £55 | £51 | £47 |

| COMPREHENSIVE | £83 | £79 | £74 | £70 |

| Health Insurance for 40-year-old | ||||

| Cover | £0 EXCESS | £100 EXCESS | £250 EXCESS | £500 EXCESS |

| BASIC | £53 | £46 | £42 | £39 |

| MID- RANGE | £81 | £78 | £73 | £70 |

| COMPREHENSIVE | £111 | £107 | £101 | £96 |

| Health Insurance for 50-year-old | ||||

| Cover | £0 EXCESS | £100 EXCESS | £250 EXCESS | £500 EXCESS |

| BASIC | £78 | £74 | £70 | £66 |

| MID- RANGE | £110 | £100 | £83 | £79 |

| COMPREHENSIVE | £154 | £143 | £121 | £103 |

For more accurate and tailored pricing, we recommend contacting our advisors. They will guide you through the process and help you find the best policy at the most competitive price.

What factors affect the price of personal private health insurance?

There are various ways you can influence the cost of private health insurance cover. Here are some factors to consider:

Age

Age is one of the most significant factors in health insurance premiums. As you get older, you generally require more medical care, making you riskier to insure. Consequently, premiums tend to increase with age.

Location

The area where you live can influence your health insurance costs. Healthcare costs and the availability of medical facilities vary by region. Urban areas and regions with high healthcare costs tend to have higher premiums.

Health Status

Your current health status and medical history play a crucial role in pricing. Individuals with pre-existing medical conditions or a history of serious illnesses may face higher premiums or even exclusions for certain conditions.

Lifestyle

Factors like smoking, excessive alcohol consumption, and obesity can impact your health and, consequently, your insurance premiums. Smokers, for instance, often pay significantly higher premiums than non-smokers.

Policy Options

When you apply for health insurance, you’ll often have choices to tailor your policy to your needs and budget. You can select from basic, mid-range and full cover, depending on your priorities and personal choice.

No matter which one you choose, certain things are included as standard with all providers. These include inpatient and daypatient hospital care, inpatient diagnostic tests, specialist fees, cancer treatment, and some outpatient benefits like surgeries and post-treatment scans. Many insurers also provide virtual GP services, so you can talk to a doctor anytime you need to.

Excess

Opting for a higher policy excess can lower your premiums, but it also means you’ll pay more if you need private medical care. You can choose to contribute any amount towards a claim from £0, £100, £200, £500, £1000 to £5000.

Underwriting Options

You can choose between two underwriting types when applying for health insurance. Full medical underwriting typically costs less than moratorium underwriting, but it requires you to disclose your entire medical history.

Additional Benefits

Adding extra benefits like Dental and Optical Cover, Mental Health, Therapies, No-Claims Discounts, Private GP and Travel insurance can raise your monthly premium. However, options like the 6-week option can reduce your premium

Family Coverage

If you’re insuring your family members in addition to yourself, the overall cost will increase. However, family coverage is often more cost-effective than separate individual policies for each family member.

Claims History

Your claims history can impact future premiums. Frequent claims may lead to higher costs, while some health insurance policies offer no-claims bonuses that can help reduce premiums.

It’s important to remember that health insurance is not a fixed cost, and it may increase over time. Factors like medical inflation, advancements in medical treatments, and the overall cost of claims can lead to premium increases. To ensure you still receive quality healthcare at affordable rates, it’s recommended to review your options periodically and consider any changes in your circumstances.

Is it worth having private health insurance in the UK?

Private Medical Insurance offers several advantages, but it also comes with its own set of drawbacks. Here are the benefits and disadvantages of having health insurance:

Benefits

| Faster Access to Healthcare | One of the most significant benefits is quicker access to medical care. You can skip the long NHS waiting lists and receive medical treatment promptly without paying high medical bills. |

| Choice of Specialist and Hospital | With PMI, you can often choose the specific specialist you want to see and the hospital where you want to receive treatment, giving you more control over your healthcare. |

| Privacy and Comfort | Private hospitals typically offer more comfortable and private facilities, including private rooms and better amenities. |

| Cover for Non-Essential Treatments | PMI can cover private treatments that the NHS may consider non-essential, such as cosmetic surgery. |

| Tax Benefits | As a business owner, you could typically deduct the cost of providing private health insurance for your employees as a business expense. You do not need to pay taxes. |

| Comprehensive Cancer Cover | It provides access to private treatments and drugs that may not be available through the NHS, ensuring comprehensive care and options for cancer patients. |

Disadvantages

| Cost | Private health insurance can be expensive, with monthly premiums and potential excess payments. Costs tend to increase with age. |

| Exclusions and Limitations | Policies may exclude certain pre-existing conditions or limit coverage for certain private treatments, which can be a significant drawback |

| Quality of NHS | While private healthcare provides faster access, the quality of care in the NHS is generally very high. You may not necessarily receive better medical care in the private sector. |

| Limited Cover | Not all medical conditions and treatments are covered by PMI. Some health insurance policies have limitations on coverage, and you may still need to use the NHS for certain healthcare needs. |

Ultimately, whether private health insurance is worth it depends on your personal circumstances and priorities. If you value fast access to care and greater control over your healthcare choices, PMI may be beneficial. However, if you are satisfied with the NHS and do not want the added expense, it may not be necessary. It’s essential to carefully consider your needs and budget before deciding whether PMI is right for you.

How to buy the cheapest and best health insurance policy?

This part of the article explains how to make health insurance cheaper. We’ve discussed what affects its price and given some pricing examples. Now, let’s look at ways to lower the cost of health insurance.

To make your health insurance more affordable, consider these steps:

- Reduce Outpatient Cover

Adjust how much outpatient care is included. You can cover a set amount, like the first £1,000 of outpatient treatment, to save money.

- Increase Policy Excess

Raise the amount you pay when you make a claim. But be careful not to choose a very high excess that might be tough to afford.

- Add a 6-Week Option

Say you’ll use the NHS if you can get medical treatment within 6 weeks. It’ll lower costs, but you might wait longer for care.

- Local Hospital List

If you don’t live in London, focus on hospitals near you to save money.

- Shop Around

Compare insurance providers when it’s time to renew your policy. You might find a better deal elsewhere.

- Quit Smoking

Smokers pay more for health insurance. Quitting can save you money and improve your health.

- Remove Add-Ons

Check if there’s any extra coverage in your policy that you don’t need. Removing it can lower your costs.

- Switching Your Cover

If you’re looking for different features or a better price than your current policy, you might consider switching to another provider. However, make sure the new policy still covers your essential needs.

- Speak to Our Experts

Get advice from our insurance experts who can help you find the right policy for the best price and and support you during the claims process, making it simple and stress-free.

By following these steps, you can lower your insurance medical costs while still getting the coverage you need.

Stuart Hendy, Senior PMI Advisor &Editor

Stuart Hendy is a highly experienced health insurance broker with extensive knowledge of private medical insurance and private treatment. His expertise is frequently sought by industry professionals and his insights have been featured in leading financial publications. Stuart is committed to providing his clients with the best possible healthcare solutions and empowering them to make informed decisions.

Frequently Asked Questions

Sources

- https://www.mytribeinsurance.co.uk/knowledge/average-cost-of-private-health-insurance-uk

- https://www.axahealth.co.uk/health-insurance/how-much-does-private-health-insurance-cost/

- https://www.hcahealthcare.co.uk/paying-for-medical-treatment

- https://www.circlehealthgroup.co.uk/paying-for-treatment/paying-for-yourself

How it works

Step 1. Answer a few simple questions

Step 2. Get tailored quote

Step 3. Get covered and start saving

Why Choose Us

We offer completely free and no obligation advice on Private Health Insurance. Our experienced advisors will take the stress away from you and do all the hard work in finding you the best Provider by comparing quotes with the top leading providers in the market. We have worked directly with AXA, Aviva, Bupa and Vitality for over 40 years, we have been tailor-making the best policies for our customers.

Health Insurance People

Get expert advice from our dedicated health insurance advisors for free

24/7 Customer Care

You can contact us anytime and one of our health insurance consultants will always be available to you.

Claims Support

We will be there for you throughout the claims process to ensure that it is easy and stress-free.