Guide to Private Health Insurance Costs in the UK

Written By: Stuart Hendy

Guide to Private Health Insurance Costs in the UK

Planning your health insurance cover ahead of time is wise. Private medical insurance costs change every year due to many reasons. These changes can affect your budget, so it’s good to know what to expect. This blog will help you understand how much your health insurance might cost. It will talk about the things that make the cost go up or down and ways to make it lower. You can also discover the price of health plans in different cities across the UK. Let’s get started.

Get Tailored Health Insurance Quotes from Top UK Insurers

Understanding the Costs of Private Health Insurance in the UK

When you’re considering private health insurance in the UK, it’s important to think about the financial side of things. To get a better idea, it’s helpful to talk to a private health insurance broker in the UK. They can explain how things like your personal circumstances affect the cost of health insurance and give you an estimate of the average expenses you might encounter in 2025.

Check how much you think you’ll spend along with the different insurance options and your healthcare needs. This research helps you plan your healthcare spending well and pick a plan that covers what you need without costing too much.

How Much Does Health Insurance Cost Depending on Your Age?

The Average Price of Private Health Insurance in 2025 is £90.03 per month. It’s important to note that this is just an average. Actual costs can differ significantly based on personal details like age and cover level. To get a better idea of health insurance costs, here’s how premiums vary by the policyholder’s age:

| Age of the Applicant | Average Cost Per Month |

|---|---|

| 20 years old | £38.36 |

| 30 years old | £51.57 |

| 40 years old | £64.25 |

| 50 years old | £83.5 |

| 60 years old | £121.60 |

| 70 years old | £193.90 |

These prices are calculated based on a few factors including moratorium underwriting, standard outpatient cover, mid-range hospital list, full inpatient and comprehensive cancer cover with a £100 excess. The difference in costs over time reflects how expenses can increase as you age. This is because the risks associated with health issues typically rise with age.

How Did Health Insurance Prices Change from 2023 to 2025?

Between 2023 and 2025, the price of medical coverage through private companies rose more than usual. This is a reflection of upcoming global trends and recovery from inflation. The private health insurance cost will likely rise prominently this year if the projections are true.

According to a survey by WTW, experts estimated costs could climb over 11.2% by 2025. This would cause a cost increase in the UK, above most other developed nations, leaving many people paying more than Europeans on average to get medical care for their loved ones.

What affects the Cost of Private Health Insurance in the UK?

A number of factors affect health insurance premiums in the UK. Although some elements can be controlled by you, others cannot be. Here’s a brief overview of such factors:

Level of Cover

Deciding between basic or comprehensive coverage affects how much you pay. Basic plans typically include core cover like some or no outpatient consultations, inpatient/ patient cover, basic level of hospital list, which can lower your premiums.

But your costs may increase if you choose comprehensive plans that include full outpatient, mid or top-level hospital lists, dental and optical cover, mental health, therapies, and travel coverage.

Some insurers like Aviva offer options like a 6-week option, where you can receive private treatment if NHS treatment isn’t available within 6 weeks. Additionally, Axa allows you to downgrade cancer cover to NHS, which can reduce your monthly premium to some extent.

Age

Typically, younger individuals may pay lower premiums because they are statistically less likely to require extensive medical care. As you get older, the risk of developing health issues increases. Therefore, health insurance providers may charge higher premiums to older individuals to account for this increased risk.

Insurers often group policyholders into age bands, with premiums increasing as you move into higher age brackets. This reflects the higher likelihood of health problems as you age.

When renewing your policy each year, your premium may increase as you age, even if your health status remains the same. This is because age is a key factor in determining risk and therefore affects the cost of your plan.

Postcode

Insurance companies usually look at how much healthcare costs in your area. If healthcare is pricier where you live because lots of people need it or it’s expensive to live there, your insurance might cost more to help cover those costs.

In places like London, healthcare costs can be significantly higher compared to other regions because you have more demand, a higher cost of living, and healthcare professionals earning higher salaries. Hospitals like HCA in London often charge premium rates for their services because they’re known for providing quality care and advanced medical facilities that you might need.

Hospital List

The hospitals covered by your health insurance plan can impact your premium. Basic-level hospitals tend to have lower costs, which may result in a more affordable premium. Mid-range hospitals offer a balance of quality and cost, affecting your premium moderately. Top London hospitals, known for their advanced care and higher charges, could raise your premium due to their higher expenses. Your choice of hospitals influences how much you pay for insurance, based on their quality and pricing.

Smoking Status

Using nicotine products can raise premium costs by 5-7%. You must discuss it with your private health insurance broker in the UK. They can tell you about the services your insurance company provides if you have any such habits.

Excess

The excess you choose can affect your monthly premium. With a lower excess like £0 or £100, you pay less upfront for treatment, but your premium might be higher. A higher excess, like £500 or £1000, means you pay more if you need care, but your premium is usually lower. Consider what you can afford to pay upfront and how often you might need medical care when choosing your excess.

Medical History

If you’ve had cancer, heart issues, or joint problems, your premium might be higher because you’re seen as a higher risk. Some insurers may even exclude coverage for these conditions. If your medical history is clean, your premium is likely lower. Before buying insurance, check how your medical history affects your coverage. It’s important to be honest about your health history to avoid problems later on.

Claims History

If you’ve made lots of claims, insurers might exclude certain conditions for a period, unless you’ve been signed off. This means you might not be covered for those conditions for a while. Also, your premium will likely be higher because insurers see you as more likely to claim again.

Getting through these complexities can be tough. But don’t worry! Premiere PMI, your trusted private health insurance broker in the UK, is here to help. We’ll create a custom solution just for you that fits your budget, needs, and health history perfectly. With our expertise, you can feel confident that you’re getting the best coverage possible. Let us guide you to the perfect health insurance plan!

Health Insurance Costs Across the UK

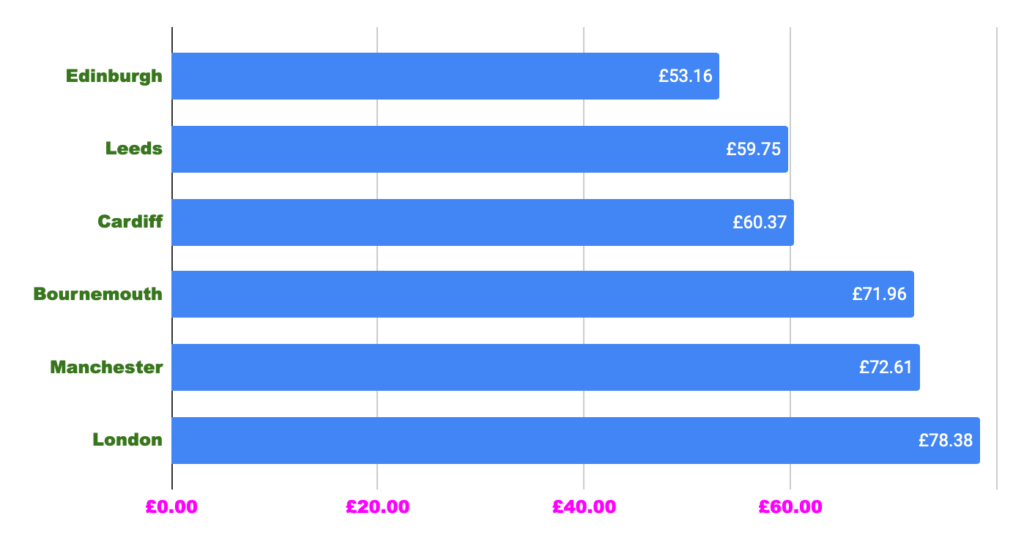

Our health insurance specialists researched how health insurance premiums vary from one city to another. The data compared the average cost for a 40-year-old healthy non-smoker individual with basic cover, a mid-range hospital list, standard outpatient cover, and moratorium underwriting with a £100 excess. Looking at health insurance costs across the UK, you’ll notice big differences in premiums between cities.

These prices are accurate as of March 2025

Looking at the chart, London’s costs are 22% higher than the national average. Bournemouth isn’t far behind, with premiums 13% above average. Manchester also has rates above average, with a 12% increase.

On the other hand, there are more affordable options. Edinburgh offers the most savings, with prices 17% below average. Leeds follows with rates 7% lower than the national benchmark, and Cardiff provides a 6% reduction compared to the average.

This breakdown shows us how your monthly insurance premiums can vary depending on whether you’re in London or another city. The data indicates that living in cities like London or Manchester could mean your premiums are hundreds of pounds higher each year compared to living in Edinburgh or Leeds.

Ways to reduce your premium

Lower your outpatient cover

Depending on how often you might use your policy, you can choose lower outpatient cover. For instance, if you’re young and healthy, you’re less likely to need outpatient care. In this case, you could select a standard outpatient cover with a £750 yearly limit for consultations. However, you can still opt for unlimited tests, scans and diagnostics. Setting an annual limit can help lower premiums while keeping key benefits unaffected.

Increase Policy Excess

You can lower your monthly premium by choosing a higher excess. With a higher excess, you agree to pay more out of pocket before your insurance kicks in. This reduces the risk for the insurer, so they may offer you a lower premium. Just make sure you can afford the excess if you need to make a claim. Adjusting your excess is a simple way for you to control your monthly premium and save money on your health insurance.

Lower Your Hospital List

Choosing insurer-recommended specialists can significantly lower your premium, often by around 20%. However, this might limit your options for doctors and hospitals. Axa’s Guided Specialist option is notable among insurers, offering choices from their Hospital Directory list. By selecting providers from this list, you can enjoy reduced premiums while still accessing quality care, providing you with a cost-effective solution for your health insurance needs.

Comparing and Switching

Regularly comparing and switching insurance plans can significantly reduce your monthly premium. Research shows you can save up to 38% by comparing different providers, especially at renewal. This ensures you get the best deal from private medical insurance providers in the UK. A broker can simplify this process, potentially saving you both time and money.

Note: It’s crucial to carefully check for shortfalls, especially if you have a pre-existing condition or have made a claim in the past 12 months with your current provider.

Remove Extra Benefits

Check your plan terms to see if you can remove any optional extras you don’t use often, like private health insurance for mental health or travel insurance. You might already have dental and optical cover through your bank or find a cheaper standalone policy. For instance, removing dental and optical cover can save you up to £20 on your monthly premium, helping you cut costs.

Healthy Lifestyle

Insurers such as Vitality Health and Aviva offer rewards for a healthy lifestyle. Aviva can lower your premium based on your BMI, while Vitality rewards you for hitting daily step goals, leading to premium reductions at renewal depending on your health. Vitality and AXA also provide gym discounts to help you stay healthy. Taking care of your health not only benefits you physically but can also save you money on your insurance premiums with these incentives.

Quit Smoking

Those who don’t smoke tend to benefit from reduced premiums on various coverage since they face lower risks of medical issues down the road. Quitting could translate to meaningful savings each month or the year.

Downgrade to NHS Treatments

To lower your health insurance premium, consider downgrading to NHS treatments. Aviva offers a 6-week option where you’ll be seen privately if NHS treatments aren’t available within 6 weeks, reducing your monthly premium. Similarly, insurers like AXA allow you to downgrade to NHS cancer treatments, significantly decreasing your premium. Choosing these options can help you save money while still ensuring you receive timely care when needed.

Find a Broker

Using a health insurance broker can help you understand what’s covered and what’s excluded, while also lowering your premium by comparing different providers.

How Can We Assist You?

At Premier PMI, we’ve been helping people with their healthcare coverage needs for over four decades now. We know choosing an insurance plan can be challenging, which is why our team is committed to providing helpful guidance tailored specifically to you. We pride ourselves on not just being brokers but becoming partners in your health journey every step of the way. Our goal is to ensure you have timely access to top specialists when you need care most. Additionally, using our services could save you up to 38%. Whether you are looking for private health insurance over 60 in the UK or any other plan, we can assist you. Reach out today to get a quote customised for your needs. You’ll see why so many families rely on the friendly, caring team at Premier PMI to secure their good health.

Stuart Hendy, Senior PMI Advisor &Editor

Stuart Hendy is a highly experienced health insurance broker with extensive knowledge of private medical insurance and private treatment. His expertise is frequently sought by industry professionals and his insights have been featured in leading financial publications. Stuart is committed to providing his clients with the best possible healthcare solutions and empowering them to make informed decisions.

Sources

FAQ

How it works

Step 1. Answer a few simple questions

Step 2. Get tailored quote

Step 3. Get covered and start saving

Why Choose Us

We offer completely free and no obligation advice on Private Health Insurance. Our experienced advisors will take the stress away from you and do all the hard work in finding you the best Provider by comparing quotes with the top leading providers in the market. We have worked directly with AXA, Aviva, Bupa and Vitality for over 40 years, we have been tailor-making the best policies for our customers.

Health Insurance People

Get expert advice from our dedicated health insurance advisors for free

24/7 Customer Care

You can contact us anytime and one of our health insurance consultants will always be available to you.

Claims Support

We will be there for you throughout the claims process to ensure that it is easy and stress-free.