Health Insurance for Autistic Children

Health insurance for Autistic Children

Health insurance for autistic children helps families pay for diagnosis, treatment, and support. Autism is a condition that affects how a child thinks and interacts with others. This insurance is like any other health insurance in the UK. It covers assessments by specialist psychiatrists for both children and adults. It helps people understand their condition and provides treatment and support.

Get Tailored Health Insurance Quotes from Top UK Insurers

How it works

Step 1. Answer a few simple questions

Step 2. Get tailored quote

Step 3. Get covered and start saving

Why Choose Us

We offer completely free and no obligation advice on Private Health Insurance for Autistic Children. Our experienced advisors will take the stress away from you and do all the hard work in finding you the best Provider by comparing quotes with the top leading providers in the market. We have worked directly with AXA, Aviva, Bupa and Vitality for over 40 years, we have been tailor-making the best health insurance policy for pre-existing conditions for our customers.

Health Insurance People

Health Insurance People

24/7 Customer Care

24/7 Customer Care

Claims Support

Claims Support

What is Autism Spectrum Disorder?

Autism is a condition that affects how children think, communicate, and interact with others. Kids with autism might find it hard to understand social cues, talk about their feelings, or handle changes in their routine. Every child with autism is different, and it can affect them in different ways. Some may struggle with learning or behavior, while others may have special skills. Autism is not always easy to spot when children are very young, and it might not be diagnosed until they are older.

How does health insurance for Autistic Children work?

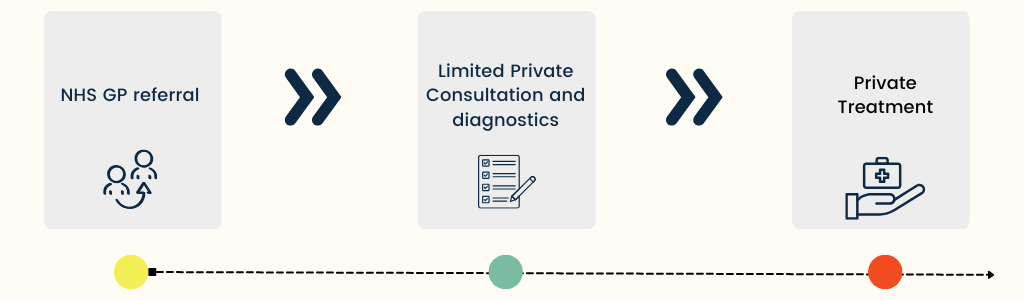

Health insurance for autistic children works just like any other health insurance. It covers new acute health issues that happen after the policy starts. However, it may not cover any pre-existing conditions before the health plan began. Health insurance for autistic children can cover assessments and tests to diagnose the condition. But ongoing treatment for the condition may not be included, as autism is considered a long-term (chronic) condition. Any other new health problems will be covered.

What does health insurance for autistic children cover?

Core (Basic) Level

The basic level cover is the most basic option. It includes NHS diagnostics and specialist services, but it does not cover outpatient treatments. However, it does provide full private inpatient and day patient cover, which means you are covered for overnight stays and day surgeries in private hospitals. It also offers full cancer cover, ensuring that all costs related to cancer treatment are covered.

Mid-Range Level

The mid-range level cover provides more benefits than the basic plan. It includes some outpatient cover and diagnostics, meaning you are covered for some tests, consultations, and treatments that don’t require a hospital stay. Like the basic plan, it offers full private inpatient and day patient cover, as well as full cancer cover, covering all cancer treatments.

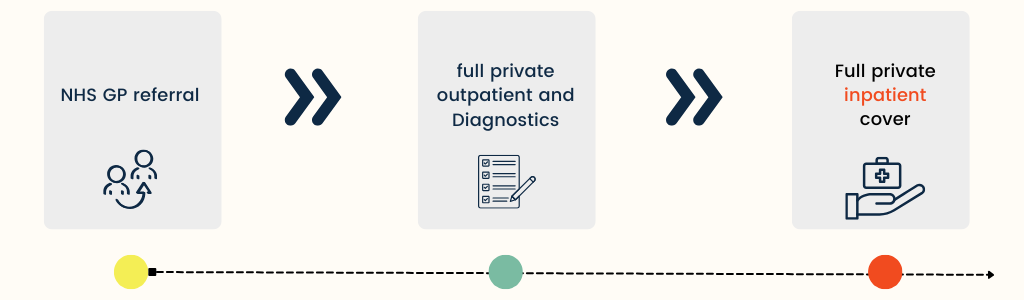

Comprehensive Level

The comprehensive level cover is the most complete plan. It provides full outpatient cover, which means you are covered for all types of outpatient treatments, including consultations, tests, and non-hospital treatments. It also includes full private inpatient and day patient cover, and like the other plans, it provides full cancer cover, covering all costs related to cancer treatment.

Each level offers different services, with comprehensive cover providing the most extensive protection.

Comprehensive cancer cover

Comprehensive cancer cover in health insurance pays for diagnosis, treatment, and ongoing care. It includes consultations, scans, and tests for early detection. It covers hospital stays, surgery, chemotherapy, radiotherapy, and targeted therapies. Some policies also include advanced treatments not always available on the NHS. Follow-up care, regular check-ups, and monitoring after treatment are covered. Palliative care and hospice support may be included for later-stage cancer. This cover ensures quick access to the best medical care, reducing financial stress and improving treatment outcomes.

Additional benefits

You can enhance your private health insurance by adding optional add-ons to your plan for an extra premium. This gives you access to additional benefits that can make your policy more comprehensive. Here are some of the upgrades available:

Upgrade Your Hospital List

You can enhance your private health insurance by adding optional add-ons to your plan for an extra premium. This gives you access to additional benefits that can make your policy more comprehensive. Here are some of the upgrades available:

Dental and Optical Cover

Adding dental and optical cover means your insurance will cover routine dental check-ups, treatments and eye care, cashback for glasses or contact lenses. This helps with costs that are often not covered by basic health insurance.

Physiotherapy

You can include physiotherapy cover in your policy. This covers treatments for joint and muscle problems, helping you recover from injuries or manage long-term conditions. It may also cover alternative therapies like acupuncture and chiropractic care to help with pain relief and overall wellness.

Mental Health Cover

Mental health cover includes face-to-face consultations with mental health professionals. This can help with issues like anxiety, depression and stress. Having this option ensures you get the support you need when you need it most.

Worldwide Travel Insurance

With worldwide travel insurance, you are covered for medical emergencies when traveling abroad. This is especially useful if you’re planning to travel for business or leisure. It ensures that you have access to healthcare no matter where you are in the world. These additional benefits are available with providers like Vitality Health and AXA Health.

Our expert says…

“Pre-existing health insurance: Your shield against uncertainties, ensuring care and support when you need it most. Peace of mind that stands strong, empowering you to face life’s challenges with confidence and security “

– Stuart Hendy, PMI expert

Save money on your health insurance policies.

What does health insurance not cover for Autism?

| Autism Diagnosis | Not covered unless done privately. |

| Educational Support | Typically not covered, as it is provided by local authorities. |

| Long-Term Care | Not usually included in insurance and managed by social care funding. |

| Social Services | Private health insurance doesn’t cover personal assistants or care workers. |

| Therapies | Limited coverage for therapies like ABA, speech or occupational therapy. |

| Specialised Treatments | Alternative or non-mainstream therapies often are not covered. |

| Assistive Technologies | Typically not covered unless related to a medical condition. |

Benefits of health insurance for autistic children

A study backed by the National Autistic Society shows that autism diagnoses in England have increased in recent years. This is because more people are aware of autism and doctors have better ways to diagnose it. With private health insurance, you can get autism assessments and diagnoses much faster than through the NHS.

Here is a line graph showing the increase in autism diagnoses in children over the past 10 years.

What is the best health insurance option for autistic children?

Health insurance for children works the same for all kids. Not all health insurance providers in the UK offer child-only policies. Providers such as Bupa, AXA and Aviva offer health plans specifically designed for children under 18.

- Gives children access to central London hospitals, no matter where the parents choose.

- Includes mental health coverage in the plan without extra costs.

- Ranked as one of the top providers by Defaqto, focusing only on medical insurance.

- Easy access to pediatric specialists and consultants for specialized care

- Offers a large list of hospitals, with special care options available.

- Generally cheaper than Bupa and Aviva for child-only plans, especially with the basic outpatient list.

- Offers the best coverage for cancer treatment.

- Covers mental health services to support emotional well-being

- Provides coverage for vaccinations and routine health checks to promote early health management.

How much is health insurance for Autistic Children?

Private health insurance premium for autistic children is generally the same as for all children. Many insurers assess risk based on pre-existing conditions, which can affect cover and premium. However, several general factors determine premiums among all insurance providers.

| Age | The age of the insured child is one of the primary factors influencing premiums. Generally, younger children, especially those under five, have lower premiums because they are considered less likely to need extensive medical care. However, as children grow older, their healthcare needs tend to increase due to developmental stages, which can lead to higher premiums for children aged 5 and above. |

| Postcode | The location where you live plays a significant role in determining your health insurance premium. Areas with a higher cost of healthcare services, more expensive medical providers or higher demand for healthcare can result in higher premiums. The postcode may influence access to certain hospitals or medical networks, further impacting premiums. |

| Hospital Choice | When selecting health insurance, the hospital network included in the plan can affect the premium. Insurance plans that provide access to HCA hospitals or prestigious medical centers, like in Harley Street, generally come with higher premiums. If you choose a more limited list of hospitals or a specific network of care providers, the premium may be lower. The level of care available within that network can also contribute to the cost. |

| Excess | The excess is the amount of money you agree to pay before your insurance policy covers the rest of your medical expenses. If you choose a higher excess £500 or £1,000, it means you will pay more out-of-pocket before the insurer steps in, but the premium will be lower |

Health insurance cost for a child

Here is the table summarising the average health insurance premiums for autistic children:

| Age Group | Aviva | AXA | Bupa |

|---|---|---|---|

| Under 5 | £19.30 | £18.90 | £23.01 |

| 5-10 | £23.20 | £21.40 | £28.90 |

| 10-18 | £33.70 | £29.80 | £42.60 |

These premiums are based on healthy children, with a £100 excess, a selected hospital list, limited outpatient care and the HA1 postcode.

How to choose the right health plan?

Before getting health insurance, consider whether it is the right choice for you. The NHS provides excellent free healthcare for children in the UK, including general medical care, specialist referrals, and emergency treatment. Private health insurance can offer faster access to treatment, but it does not cover autism or any related conditions, such as speech therapy, occupational therapy or autism assessments.

If you decide to get health insurance, compare different plans to find one that fits your needs and budget. You can do this in two ways:

Research online – most health insurance providers have websites where you can check available cover and benefits.

Speak to a broker – a broker is a professional who can guide you through different insurance options. They compare plans from different insurers and help you choose the best one.

A broker can save you time and effort by explaining complex policies and ensuring you get the most value for your money.

How to apply for health insurance for autistic children?

The application process for children’s health insurance is straightforward, but there are some important things to know.

Online

You can start your application on an insurance company’s website. However, you will still need to speak with an insurer to complete the process.

Directly with an insurer

If you contact an insurer directly, they can only offer their own products. This means you might miss out on better deals from other companies.

Using a broker

A broker can compare multiple insurance providers and help you choose the best plan. They assist with paperwork, ensure your documents are submitted correctly, and answer any questions you may have.

In conclusion, health insurance for autistic children can provide valuable support for diagnoses. While it won’t cover every aspect of autism-related needs, such as therapies or educational support. Health policy also ensures quick access to private treatment for any acute conditions after the policy start date, so your child won’t have to endure distress or pain while waiting for care. When choosing a plan, it is important to consider the various plan options, premiums and benefits. Our professional advisors at Premier PMI are here to guide you through the process, ensuring you find the right health insurance plan for your child’s specific requirements and providing expert assistance every step of the way.

What customers say about us

Frequently Asked Questions

Have any questions?

Send us a message and one of our dedicated advisors will contact you shortly.